October 29, 2010 :: Permalink

Dear Shawn,

(forwarded by email to: Shawn Tully)

Wow, all that education and you really don't understand economics ... too bad! You seem like a decent guy. Why don't you have a conversation with a real economist?

You wrote in today's article:

"By 2013, the total U.S. federal debt will total 76% of GDP if Congress remains gridlocked, and digging out at that point will be unimaginably painful."

During the Great Depression and WWII, U.S. federal debt totaled some 120% of GDP - we didn't dig out at all. The economy grew and overtime, this debt was "relatively" unimportant. We never paid it back essentially.

You added, "when the outgoing dollars exceed those coming in by 63%––the actual number in the fiscal 2010 budget––it's the same reckless behavior as if they paid for rent and groceries by running up gigantic credit card bills certain to destroy them in the future."

I'm not sure these numbers are correct. I believe the FY 2010 deficit was around $1.2T with some $3.6T of outlays. I'm just pulling from memory so these aren't exact. Please correct me.

My rough numbers suggest "those coming in" came to about $2.4T. Wouldn't the debt to revenue ratio be closer to 50%.

Yet my numbers may be off ... my point is what would you have preferred? Can you imagine what would have happened to the economy had Obama (or Bush) balanced the budget?

Come on, dude! Seriously ... what would have happened had the U.S. federal government cut spending - this would have put more federal workers in unemployment lines; the stimulus paid for 10,000s of state teachers and public workers. They would have been in unemployment lines - asking for benefits (increasing debt).

Taxpayers would have supported them - yet we wouldn't have received the services. States like Hawai'i that suffered 17 days of Furlough Fridays in their public schools would have needed to implement more.

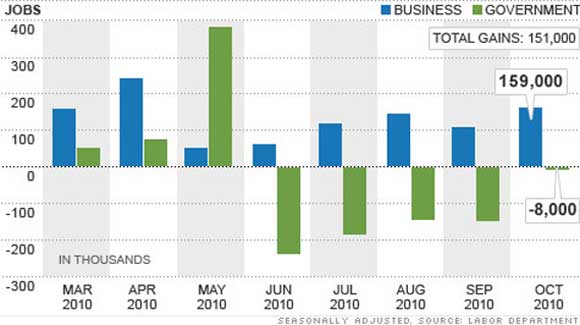

Due to federal deficit spending, citizens received services - not simply supported payments. From CNN today, October jobs report: Hiring picks up. See chart below.

Our federal deficit, national debt and government spending did not impede job growth. Interest rates remain low -- too low in fact. The stock market recovered nicely. Best growth in decades. The dollar is somewhat weaker, yet better for our exports and also helps deter us somewhat from importing cheap good from China and elsewhere. Outside the unemployment numbers, conditions are relatively positive considering the depth of the Great Recession.

Yes, we ran up debt. Good lesson! Control the f*cking banks and private sector. Let's not forget who was irresponsible here. This wasn't middle class families running up debt simply for "rent and groceries."

So, dude, use that excellent brain of yours - stop repeating failed slogans and generalizations. You are more talented than this ...

Merci -

Scott

Shawn's Response, Fri, 05 Nov 2010 10:51:50

Scott- revenues in 2010 are 2.143 trillion and outlays are 3.485 trillion, so outlays exceed revenues by 3.485 - 2.142 = 1.34 divided by 2.143 or 62%.

The 1.34 trillion is obviously the deficit.

You can find this number on page 4 of the CBO budget report for June.

The idea that going to over 100% of gdp in debt is healthy is incorrect. Debt will go to well over that number WITH HEALTHY GROWTH RATES AS PROJECTED BY BOTH THE ADMINISTRATION AND THE CBO. WE CANNOT GROW OUT OF THIS PROBLEM WITH 3-4% GROWTH RATES. The debt simply gets higher.

Best, Shawn

My Response, Fri, 05 Nov 2010 10:51:50

Thanks for writing and I appreciate the accurate numbers. I accept your 63% figure.

As you know, I'm not saying going over 100% is healthy. I'm saying this is what the U.S. had to do to climb out of the Great Depression and win WWII. We survived! On the other hand, I didn't think collapsing the financial sector was healthy. I'm sure you didn't either. You and I both agree.

Yet you're a smart guy, we're talking about solutions now ... what would have happened had we not deficit spent in FY2010 or FY2009. Would that have been acceptable?

Let's work on options. I know that is what you want. If we balance the budget for FY2011 - cutting some $1.3 trillion in federal spending - while around 40 states are expected to run red ink, what will happen? I know you aren't advocating increases in taxation, are you?

There will be massive job cuts in federal and state programs. This translates into more job losses. The private sector is not in a position to hire these workers. Unemployment and medicaid costs will explode. The economy will begin to free fall downward.

Consumer spending is anemic today. Thousands of job cuts, along with slashing both federal and state contracts that fund work done by private sector companies, will become a MASSIVE anchor on our struggling economy. This will put more people out of work. These families will no longer be able to consume, which will depress the private sector further.

So, dude, how do you see this playing out?

Shawn's Response ...

Shawn didn't respond. You see, America's best and brightest aren't really that bright. Yours Truly, an economist from a state college in Idaho, wiped the floor with this high priced, phoney analyst from the East Coast.

Kicked his ass would be more to the point ... I kicked your ass, dude!

Yet Shawn keeps his job and will continue to mislead and scare Americans. This is the state of the United States today. Overprices blowhards get paid BIG MONEY to lie to you. They don't care if the economy crashes or we punish an excellent president. It's all about saying and writing BULLSHIT so they get paid.

Dear Shawn,

(forwarded by email to: Shawn Tully)

Wow, all that education and you really don't understand economics ... too bad! You seem like a decent guy. Why don't you have a conversation with a real economist?

You wrote in today's article:

"By 2013, the total U.S. federal debt will total 76% of GDP if Congress remains gridlocked, and digging out at that point will be unimaginably painful."

During the Great Depression and WWII, U.S. federal debt totaled some 120% of GDP - we didn't dig out at all. The economy grew and overtime, this debt was "relatively" unimportant. We never paid it back essentially.

You added, "when the outgoing dollars exceed those coming in by 63%––the actual number in the fiscal 2010 budget––it's the same reckless behavior as if they paid for rent and groceries by running up gigantic credit card bills certain to destroy them in the future."

I'm not sure these numbers are correct. I believe the FY 2010 deficit was around $1.2T with some $3.6T of outlays. I'm just pulling from memory so these aren't exact. Please correct me.

My rough numbers suggest "those coming in" came to about $2.4T. Wouldn't the debt to revenue ratio be closer to 50%.

Yet my numbers may be off ... my point is what would you have preferred? Can you imagine what would have happened to the economy had Obama (or Bush) balanced the budget?

Come on, dude! Seriously ... what would have happened had the U.S. federal government cut spending - this would have put more federal workers in unemployment lines; the stimulus paid for 10,000s of state teachers and public workers. They would have been in unemployment lines - asking for benefits (increasing debt).

Taxpayers would have supported them - yet we wouldn't have received the services. States like Hawai'i that suffered 17 days of Furlough Fridays in their public schools would have needed to implement more.

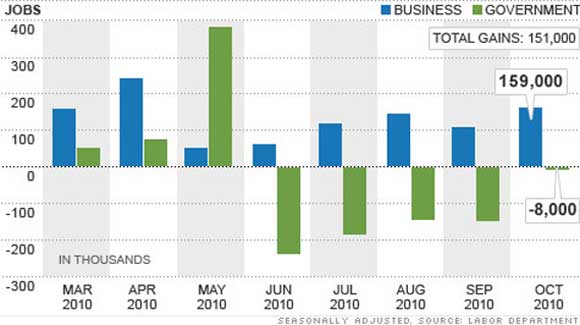

Due to federal deficit spending, citizens received services - not simply supported payments. From CNN today, October jobs report: Hiring picks up. See chart below.

Our federal deficit, national debt and government spending did not impede job growth. Interest rates remain low -- too low in fact. The stock market recovered nicely. Best growth in decades. The dollar is somewhat weaker, yet better for our exports and also helps deter us somewhat from importing cheap good from China and elsewhere. Outside the unemployment numbers, conditions are relatively positive considering the depth of the Great Recession.

Yes, we ran up debt. Good lesson! Control the f*cking banks and private sector. Let's not forget who was irresponsible here. This wasn't middle class families running up debt simply for "rent and groceries."

So, dude, use that excellent brain of yours - stop repeating failed slogans and generalizations. You are more talented than this ...

Merci -

Scott

Shawn's Response, Fri, 05 Nov 2010 10:51:50

Scott- revenues in 2010 are 2.143 trillion and outlays are 3.485 trillion, so outlays exceed revenues by 3.485 - 2.142 = 1.34 divided by 2.143 or 62%.

The 1.34 trillion is obviously the deficit.

You can find this number on page 4 of the CBO budget report for June.

The idea that going to over 100% of gdp in debt is healthy is incorrect. Debt will go to well over that number WITH HEALTHY GROWTH RATES AS PROJECTED BY BOTH THE ADMINISTRATION AND THE CBO. WE CANNOT GROW OUT OF THIS PROBLEM WITH 3-4% GROWTH RATES. The debt simply gets higher.

Best, Shawn

My Response, Fri, 05 Nov 2010 10:51:50

Thanks for writing and I appreciate the accurate numbers. I accept your 63% figure.

As you know, I'm not saying going over 100% is healthy. I'm saying this is what the U.S. had to do to climb out of the Great Depression and win WWII. We survived! On the other hand, I didn't think collapsing the financial sector was healthy. I'm sure you didn't either. You and I both agree.

Yet you're a smart guy, we're talking about solutions now ... what would have happened had we not deficit spent in FY2010 or FY2009. Would that have been acceptable?

Let's work on options. I know that is what you want. If we balance the budget for FY2011 - cutting some $1.3 trillion in federal spending - while around 40 states are expected to run red ink, what will happen? I know you aren't advocating increases in taxation, are you?

There will be massive job cuts in federal and state programs. This translates into more job losses. The private sector is not in a position to hire these workers. Unemployment and medicaid costs will explode. The economy will begin to free fall downward.

Consumer spending is anemic today. Thousands of job cuts, along with slashing both federal and state contracts that fund work done by private sector companies, will become a MASSIVE anchor on our struggling economy. This will put more people out of work. These families will no longer be able to consume, which will depress the private sector further.

So, dude, how do you see this playing out?

Shawn's Response ...

Shawn didn't respond. You see, America's best and brightest aren't really that bright. Yours Truly, an economist from a state college in Idaho, wiped the floor with this high priced, phoney analyst from the East Coast.

Kicked his ass would be more to the point ... I kicked your ass, dude!

Yet Shawn keeps his job and will continue to mislead and scare Americans. This is the state of the United States today. Overprices blowhards get paid BIG MONEY to lie to you. They don't care if the economy crashes or we punish an excellent president. It's all about saying and writing BULLSHIT so they get paid.