The Big Bang: Stimulus Tracker

While I applaud much of the Obama administration's effort to pull our nation from the brink of financial collapse, it is painfully clear today the recession is over — for everybody except you — the American citizen.

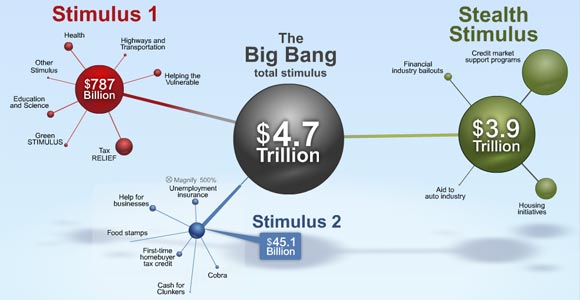

This graphic from CNN illustrates why American families are still being hammered by the Great Recession. I argued in 2008 when the Bush administration was implementing the TARP rescue program that this was a TOP down approach. Beginning with Ronald Reagan in the 1980s our conservative economic policy directed our nation to focus our attention on America's MOST RICH and hope crumbs would eventually trickle down to individual households. After 30 years, economic data show this experiment was a massive failure. See Growing Income Inequality.

CNN points out Stimulus 1 & 2, about $830 billion, focused on jobs, education and programs that directly affect working families. On the other hand the lion's share of the The Big Bang, about $3.9 TRILLION (83%), went to corporate America. Little went to states and while the federal government was pursuing policies to stimulate the economy, the 50 states were cutting spending, contracting, and acting like a huge anchor on our struggling ship of state.

Yet individual consumers drive a growing national economy (see below, What Recession?). You need money in your pocket. When you have money, you buy and spend. Businesses order more products, which opens up factories. Factories hire more workers, who can then buy and spend and continue the cycle. President Obama appears to be waking up to this disparity. Don't let up ... continue contacting your elected officials.

This graphic from CNN illustrates why American families are still being hammered by the Great Recession. I argued in 2008 when the Bush administration was implementing the TARP rescue program that this was a TOP down approach. Beginning with Ronald Reagan in the 1980s our conservative economic policy directed our nation to focus our attention on America's MOST RICH and hope crumbs would eventually trickle down to individual households. After 30 years, economic data show this experiment was a massive failure. See Growing Income Inequality.

CNN points out Stimulus 1 & 2, about $830 billion, focused on jobs, education and programs that directly affect working families. On the other hand the lion's share of the The Big Bang, about $3.9 TRILLION (83%), went to corporate America. Little went to states and while the federal government was pursuing policies to stimulate the economy, the 50 states were cutting spending, contracting, and acting like a huge anchor on our struggling ship of state.

Yet individual consumers drive a growing national economy (see below, What Recession?). You need money in your pocket. When you have money, you buy and spend. Businesses order more products, which opens up factories. Factories hire more workers, who can then buy and spend and continue the cycle. President Obama appears to be waking up to this disparity. Don't let up ... continue contacting your elected officials.

What Recession?

[6.26.09] Americans clearly aren't the brightest bulbs in the global chandelier, but one can't blame them when we consider all the fear-mongering and false information on TV and in the media. Yet people ... WAKE UP!!! You are now causing the economy to sputter.

Yes, we faced problems of catastrophic proportions due to greedy lending practices, incompetent financial administration and short-sighted portfolio management. Due to the skilled leadership of the Obama administration, this is slowly turning around.

On the other hand, Obama has put more money in your hands. What have you done in return? Hid these funds in your mattress! The savings rate rose in May to 6.9 percent ~ the highest in 16 years! Only a few years ago (2008), we were saving 0.0 percent as a nation. Going from 0.0 to 6.9 percent has created a HUGE drag on the economy.

Consumers account for about 70 percent of the total economic activity for the nation. Our current savings rate (6.9%) represents a 4.8 percent anchor on the American economic recovery. Recent government reports show our economy contracted at a 5.5 percent annual rate. The lack of consumer spending (or our high savings rate) makes up 87 percent of the recessing economy. President Obama is doing his part to stimulate our economy yet it's like 300 million people are dangling their feet in the water as he tries to turn the "ship of state."

Help out! Spend where you can. Don't waste your money, but replace the old windows in your home; install a new, energy efficient furnace or AC unit. Get rid of your old, gas-guzzling clunker and buy a fuel efficient vehicle. Go on a needed vacation. This isn't the time to be saving. Pay down debts, have some fun and help your country...

Yes, we faced problems of catastrophic proportions due to greedy lending practices, incompetent financial administration and short-sighted portfolio management. Due to the skilled leadership of the Obama administration, this is slowly turning around.

On the other hand, Obama has put more money in your hands. What have you done in return? Hid these funds in your mattress! The savings rate rose in May to 6.9 percent ~ the highest in 16 years! Only a few years ago (2008), we were saving 0.0 percent as a nation. Going from 0.0 to 6.9 percent has created a HUGE drag on the economy.

Consumers account for about 70 percent of the total economic activity for the nation. Our current savings rate (6.9%) represents a 4.8 percent anchor on the American economic recovery. Recent government reports show our economy contracted at a 5.5 percent annual rate. The lack of consumer spending (or our high savings rate) makes up 87 percent of the recessing economy. President Obama is doing his part to stimulate our economy yet it's like 300 million people are dangling their feet in the water as he tries to turn the "ship of state."

Help out! Spend where you can. Don't waste your money, but replace the old windows in your home; install a new, energy efficient furnace or AC unit. Get rid of your old, gas-guzzling clunker and buy a fuel efficient vehicle. Go on a needed vacation. This isn't the time to be saving. Pay down debts, have some fun and help your country...

Will Your Fear Cause You To Be Duped Again?

While I am more confident with Barack in the White House, we face unprecedented challenges, and frankly, the continuation of our nation is at risk. Individually, you are facing an economic tsunami as well. I recommend reading an overview about our desperate situation written by Peter Peterson and David Walker:

I.O.U.S.A :: One Nation. Under Stress. In Debt.

When I speak to Americans about our current meltdown, I begin by focusing on the damage done to our nation by Ronald Reagan, i.e., Reagonomics. For those on the right, this is tantamount to waving a red flag before a bull ... nobody is allowed to criticize their hero. While Mr. Reagan had many admirable qualities, his warped perspective about the role of government, emphasis on deregulation and libertarian principles, set in motion the economic forces that brought America and the western world to its knees in late 2008. Paul Krugman provides an excellent summary of this process:

Reagan Did It

Keep in mind as you read the Citizen's Guide that you were warned ... Al Gore, when running for president in 2000, pleaded with us to put our social security tax revenues in a "lock box." This would have shored up the program. Yet conservative leaders and pundits ridiculed Gore. They hate "New Deal" programs that provide the safety net for Americans. When George W. Bush entered the presidency, he drained the Treasury by giving back historic tax rebates to the most wealthy. These policies helped create the massive economic problems we currently face. Don't forget who [Republicans] led us into this financial quagmire and caused so much suffering and distress.

Let me get right to the point. The Bush administration's federal bailout proposal, as furthered by Treasury Secretary Paulson, will not work; in fact, it will make our financial crisis even worse. Keep in mind I warned readers in 2002-03 that blazing into Iraq would result in disasterous consequences. Usama bin Laden and al Qaeda prayed for us to take this misguided action — for they wanted to bankrupt the United States of America.

This solution will not be pain free. There are few good options left. The federal government must initiate a ground up rescue. By preventing foreclosures, halting bankruptcies, and restructuring homeowner debt, the paper IOUs at the bottom of the commercial credit food chain will remain viable. If the foundation remains strong, then the subsequent levels of securities IOUs will remain solvent as well. Ultimately, this is an issue of confidence. If a domino at the bottom falls, it will take others with it. As Wall Street firms have leveraged their obligations 20-30 times (or more), the fall of a single domino causes a financial chain reaction throughout the global economic community.

Periodical Updates Added Below

History

On Friday, September 19th, Secretary Paulson released an amazingly brief, three-page, document that outlined his plan to "save the U.S. financial system," i.e., fat cats on Wall Street. There wasn't much to the proposal: give the secretary $700 billion in a "clean bill" — meaning no strings attached, no oversight, and no allowable review from federal agencies or the courts. Talk about creating a Financial Tsar!

The $700 billion requested by Paulson is a strange figure. How did he come up with this? "It's not based on any particular data point," a Treasury spokeswoman said. "We just wanted to choose a really large number." [source]

We've heard the false cries of the wolf from the Bush administration previously. Therefore, let's break this down. This crisis stems from the trouble in the housing market. If we use the research of Devilstower:

Rip off common citizens coming into office ... rip them off heading out the door. By any measure, scholars will conclude that George W. Bush was the greatest Republican president in U.S. history!

George W. Bush's Incompetence

Bush's negligent practices run deep. Although the CIA, in their daily presidential briefing on August 5, 2001, warned George W. Bush that Usama Bin Laden was preparing to strike inside the U.S., Bush neglected to take action. Five weeks later 19 Middle Eastern radicals attacked our nation. Bush claimed his month long vacation did not impair his judgment.

In the fall of 2002, Bush and members of his administration horrified Americans about an imminent and impending danger from the Middle East. In response the U.S. preemptively attacked Iraq six months later. No weapons of mass destruction were found; Saddam was not linked to the 9/11 terrorists. The crisis was cunningly invented to rush us into a $3 trillion war over oil with no end in sight. Secretary Paulson told us this week we must rush to bailout Wall Street. Sound familiar?

In August 2005, one of the deadliest hurricanes in history hit the U.S. coastline. While Bush and John McCain toasted McCain's birthday by eating cake in an airport celebration, nearly 2,000 Americans lost their lives. Bush told the nation that his FEMA director, Michael Brown "Brownie," was doing "a heck of a job."

Now, less than 45 days before the November presidential election, Bush announces that we are facing a Second Great Depression and the SOLE SOLUTION is to put hundreds of billions of taxpayer dollars into the unregulated and unreviewable hands of the same people who, due to their extraordinary greed and poor judgment, got us into this financial mess in the first place. Did I mention I have a bridge to nowhere in Alaska to sell you?

As with many of the current administration's plans, this proposal is flawed due to its top down approach. Bush and his Republican ideologues believe that stimulating the most wealthy will lead to economic gains that will trickle down to Main Street. Companies considered "to big to fail" will receive the lion's share of the proposed $700 billion package. Yet it is the little guy, the family living on Main Street and considered by Bush followers as "too small to save," who will rescue the nation from the grips of a Second Great Depression.

Since coming to office, Bush has focused his tax relief on those at the top. While trillions of dollars have been channeled to the most wealthy, the economy has performed miserably. Under eight years of Clinton stewardship, American businesses generated over 22 million new jobs. In contrast, Bush's Republican ideology has squeezed job creation to about five million net positions.

Bush's flawed ideology fueled a tragic insurgency in Iraq as well. The administration's plan sent too few troops into the theater, allowing our military to focus only on Saddam and his henchmen (remember the playing cards of bad guys), while leaving tens of thousands of Bathist officials and military personnel without money or dignity — but plenty of weapons and roadside bombs.

This is not the appropriate forum to debate the pros and cons of top down v. bottom up solutions, but let me give you an example of how leaders become captured by their own rhetoric and political biases.

A Child's Example

A number of years ago, I read a story about a delivery truck that had become wedged under a low handing freeway structure. The clearance was posted as 12 feet but the truck actually measured 12 feet two inches. It passed under the structure for a few feet and became wedged part way through.

City officials and their top engineers climbed ladders to inspect the dilemma. They measured the truck and freeway clearance numerous times. They discussed possibilities of bringing in hydraulic jacks to lift the structure and free the truck.

While the "experts" pondered their options, a young boy on a bike stopped by to watch the spectacle. He listened for 15-20 minutes as the engineers argued over the best way to lift the low hanging freeway.

Finally, the curious boy walked up to one of the officials and asked a simple question, "Why don't you let some of the air out of the tires on the truck?"

The experts had focused on the top down approach, while the solution was at hand from a bottom up perspective. It took a child's mind to see the most practical and effective solution.

Our "experts" in Washington are trying to lift the low hanging freeway structure. Their proposal hopes to take the economic pressure off the shoulders of leading financial firms on Wall Street. They want to buy up all the bad debt hemorrhaging in our economic system.

Adult Solutions

One of the best summaries of our current situation comes from Devilstower. This blogger captured the key ingredients of this financial meltdown. Citing research from Bob Moon and Kai Ryssday, American Public Media's Marketplace, Devilstower lists some key economic figures:

America's internal and external debt exceeds $60 trillion, over 400 percent (4 times) of the country's annual GDP of a bit over $14 trillion. This debt can be broken down as follows Source: Daily Recogning:

It is the estimated $7 trillion mortgage market, due to the bursting housing bubble, where the root of the problem lies. The defaults and lack of confidence in these investor IOUs are creating unprecedented insecurities in the credit default swap market (CDS), which is believed to be closer to $70 trillion today than Moon and Ryssday's estimated $45 trillion.

This is where the top of the U.S financial truck has become wedged under the low hanging freeway structure. While national experts measure and re-measure the truck and overpass, they propose to lift the structure with a cash infusion of $700 billion to buy up the bad assets.

In this top down approach, the $700 billion becomes a paltry drop in the bucket of the $70 trillion in CDS obligations. It is approximately 1/1000th of the total. This is like paying $1 (one dollar) toward a debt of $1,000 (one thousand dollars). The single dollar does little to instill confidence that one can eventually repay the obligation. Conversely, this additional, yet ineffective, infusion of dollars in the market will likely fuel inflation and decrease the value of the dollar in world markets.

The solution? We must let the air out of the truck tires. The solution isn't to save the $70 trillion CDS market; the solution doesn't rest with the entire $7 trillion mortgage market. The problem stems from the bad commercial paper that is circulating in the global economic system.

While the Bush administration, under the direction of Secretary Paulson, wants to find the "insurgent" paper — needles in haystacks — and remove it from the system by authorizing the federal government to buy it, the solution is to prevent any more commercial paper from becoming "bad."

This solution will not be pain free. There are few good options left. The federal government must initiate a ground up rescue. By preventing foreclosures, halting bankruptcies, and restructuring homeowner debt, the paper IOUs at the bottom of the commercial credit food chain will remain viable. If the foundation remains strong, then the subsequent levels of securities IOUs will remain solvent as well. Ultimately, this is an issue of confidence. If a domino at the bottom falls, it will take others with it. As Wall Street firms have leveraged their obligations 20-30 times (or more), the fall of a single domino causes a financial chain reaction throughout the global economic community.

Bush and Paulson want to find and buy back the bad paper within a seething network of $70 trillion worth of obligations. Good luck! By stopping the bleeding at the source, with the little guy on Main Street, confidence is restored. Increased margin calls are no longer necessary. Capital is infused into the system at the most effective point — the bottom. Let's look at a real life example:

And, just as one default can multiply through the system 20-30 times, each secured mortgage multiplies confidence upward through the network. The global panic and potential financial meltdown is averted and capital begins to loosen up and again flow freely. Let's hear how Hillary Clinton would implement such a plan:

Let the air out of the tires of this runaway truck or suffer the collapse of the entire financial freeway system. It's your money and you've been warned! Don't trust the Robbers who are running the bank.

I.O.U.S.A :: One Nation. Under Stress. In Debt.

When I speak to Americans about our current meltdown, I begin by focusing on the damage done to our nation by Ronald Reagan, i.e., Reagonomics. For those on the right, this is tantamount to waving a red flag before a bull ... nobody is allowed to criticize their hero. While Mr. Reagan had many admirable qualities, his warped perspective about the role of government, emphasis on deregulation and libertarian principles, set in motion the economic forces that brought America and the western world to its knees in late 2008. Paul Krugman provides an excellent summary of this process:

Reagan Did It

Keep in mind as you read the Citizen's Guide that you were warned ... Al Gore, when running for president in 2000, pleaded with us to put our social security tax revenues in a "lock box." This would have shored up the program. Yet conservative leaders and pundits ridiculed Gore. They hate "New Deal" programs that provide the safety net for Americans. When George W. Bush entered the presidency, he drained the Treasury by giving back historic tax rebates to the most wealthy. These policies helped create the massive economic problems we currently face. Don't forget who [Republicans] led us into this financial quagmire and caused so much suffering and distress.

[UPDATE: 12.10.08] Joseph Stiglitz posted an article in Vanity Fair writing:

[UPDATE: 11.30.08] The LA Times leads with a story titled, "Economic rescue could cost $8.5 trillion." Keep in mind I urged our nation to pursue a "bottom up" approach. There have been about a million home foreclosures in the past 18 months. These defaults have fueled the crisis. Had the U.S. government picked up the mortgages, essentially socializing these debts, the total cost would have been around $250 BILLION — not trillions as we (taxpayers) are paying now!

These homes could have been purchased by Fannie Mae or Freddie Mac. These are properties, assets, that have value. Mortgages could have been reworked and reset to lower monthly payments. People would have remained in their homes; neighborhood home values would not have fallen dramatically; and there would have been no toxic assets in the various collaterized debt obligations (CDOs) and no need to cash in credit default swaps. Your pension would be intact. The stock market would be near historic highs. The entire cost might have approached $500 billion or $0.5 trillion — instead of the estimated $8.5 trillion TO DATE.

Mr. Paulson said the $700 billion would not be used to buy up troubled mortgage-related securities, as the rescue effort was originally conceived, but would instead be used in a broader campaign to bolster the financial markets and, in turn, make loans more accessible for creditworthy borrowers seeking car loans, student loans and other kinds of borrowing." [Source]

As with Iraq, I told you these Republican leaders where misleading you and other Democratic politicians. To succeed, we must strengthen consumers and the middle class.

[UPDATE: 10.23.08] I am more comfortable with the current bailout than I was initially, as the plan has morphed considerably into a broad-based approach. Yet I want to point out the stupidity of the overall effort. At present the U.S. government has pledged approximately $1.5 trillion in spending to stem the crisis. World leaders have added another $500 billion. This is over $2 trillion and nobody is sure whether the plan will work. People remain afraid, and their fear causes them not to lend, buy, or invest in the future.

We must focus on the origin of the problem — the collapse of the U.S. housing market and defaults on mortgage payments. On the one hand, some people made unwise purchases, as the homes were too pricey relative to their income. Yet we are aware that some lenders engaged in predatory practices. On the other hand, the Bush economy has crushed the American consumer. This is a systemic problem. Wages have not kept pace with other exploading costs.

Were there other options? As I argued below, we could have stopped foreclosures. They were (and still are) creating the "toxic waste" assets in the system.

No foreclosures = no bad commercial paper = no loss of confidence.

Since 2007 there have been 851,000 foreclosures. Let's assume the average price per mortgage was $250,000. Had the federal government stepped in and purchased all these homes, thus guaranteeing the mortgages, the cost to the taxpayer would have been:

$213 billion

If we take the worst case scenario, assuming the mortgage value of the homes was twice as high, $500,000, the cost to the American taxpayer would have been:

$426 billion

This is a lot of money. Some would call this socialism. Yet even in the worst case scenario, it is less than 25 percent the cost of Bush's proposal. Is anyone arguing that bailing out banks and Wall Street investment firms isn't a socialistic policy?

You got robbed. By focusing on the homeowner, not allowing them to default, we would have shored up the financial foundation of this country. By blocking foreclosures, housing prices wouldn't have continued to collapse. People's primary investment would have remained strong. There would have been no bad commercial paper; no need to sell good assets at bargain basement prices; and no loss of confidence in the world's financial system. All this for a price in the range of $213B — $426B.

Keep in mind that the govenment would have owned these properties. People would have paid monthly to remain in the homes, although less than the previously scheduled amounts. Yet the government, i.e., the taxpayer, would have gotten their money back — by investing in the American people.

We don't have leaders in Washington — we have partisan ideologues. You are the loser. They took care of their friends. You paid the bill!

I'm a political economist. My friends rib me because they claim I not only passionately understand this stuff, but can actually teach others about free market principles and financial matters.

"The bailout package [original proposal by Treasury Secretary Henry Paulson] was like a massive transfusion to a patient suffering from internal bleeding—and nothing was being done about the source of the problem, namely all those foreclosures. Valuable time was wasted as Paulson pushed his own plan, 'cash for trash,' buying up the bad assets and putting the risk onto American taxpayers" [Source]Another Nobel Prize winning economist, along with Paul Krugman, now agrees with what I had originally recommended! Stiglitz titled his piece, "Capitalist Fools."

[UPDATE: 11.30.08] The LA Times leads with a story titled, "Economic rescue could cost $8.5 trillion." Keep in mind I urged our nation to pursue a "bottom up" approach. There have been about a million home foreclosures in the past 18 months. These defaults have fueled the crisis. Had the U.S. government picked up the mortgages, essentially socializing these debts, the total cost would have been around $250 BILLION — not trillions as we (taxpayers) are paying now!

These homes could have been purchased by Fannie Mae or Freddie Mac. These are properties, assets, that have value. Mortgages could have been reworked and reset to lower monthly payments. People would have remained in their homes; neighborhood home values would not have fallen dramatically; and there would have been no toxic assets in the various collaterized debt obligations (CDOs) and no need to cash in credit default swaps. Your pension would be intact. The stock market would be near historic highs. The entire cost might have approached $500 billion or $0.5 trillion — instead of the estimated $8.5 trillion TO DATE.

Just last week, new initiatives added $600 billion to lower mortgage rates, $200 billion to stimulate consumer loans and nearly $300 billion to steady Citigroup, the banking conglomerate. That pushed the potential long-term cost of the government's varied economic rescue initiatives, including direct loans and loan guarantees, to an estimated total of $8.5 trillion — [over] half of the entire economic output of the U.S. this year [U.S. GDP for fiscal 2008 was slightly more than $14 trillion].[UPDATE: 11.12.08] In the previous update, I mentioned that some of the new strategies made a bit more sense, yet the primary objective, buying up the toxic assets, was a stupid plan. Today, Treasury Secretary Paulson announced a "major shift in the thrust of the $700 billion financial-rescue program on Wednesday, at the same time joining several agencies in prodding banks to speed up the thaw in the country's credit system.

Washington could wind up spending substantially less than the sum of the commitments. Though the total estimated cost of the government's efforts adds up to $8.5 trillion, only about $3.2 trillion has been tapped, according to an analysis by Bloomberg. And not all the money committed is direct spending. About $5.5 trillion in loan guarantees and other financial backing by the Federal Reserve is included in the total. [Source]

Mr. Paulson said the $700 billion would not be used to buy up troubled mortgage-related securities, as the rescue effort was originally conceived, but would instead be used in a broader campaign to bolster the financial markets and, in turn, make loans more accessible for creditworthy borrowers seeking car loans, student loans and other kinds of borrowing." [Source]

As with Iraq, I told you these Republican leaders where misleading you and other Democratic politicians. To succeed, we must strengthen consumers and the middle class.

[UPDATE: 10.23.08] I am more comfortable with the current bailout than I was initially, as the plan has morphed considerably into a broad-based approach. Yet I want to point out the stupidity of the overall effort. At present the U.S. government has pledged approximately $1.5 trillion in spending to stem the crisis. World leaders have added another $500 billion. This is over $2 trillion and nobody is sure whether the plan will work. People remain afraid, and their fear causes them not to lend, buy, or invest in the future.

We must focus on the origin of the problem — the collapse of the U.S. housing market and defaults on mortgage payments. On the one hand, some people made unwise purchases, as the homes were too pricey relative to their income. Yet we are aware that some lenders engaged in predatory practices. On the other hand, the Bush economy has crushed the American consumer. This is a systemic problem. Wages have not kept pace with other exploading costs.

Were there other options? As I argued below, we could have stopped foreclosures. They were (and still are) creating the "toxic waste" assets in the system.

No foreclosures = no bad commercial paper = no loss of confidence.

Since 2007 there have been 851,000 foreclosures. Let's assume the average price per mortgage was $250,000. Had the federal government stepped in and purchased all these homes, thus guaranteeing the mortgages, the cost to the taxpayer would have been:

$213 billion

If we take the worst case scenario, assuming the mortgage value of the homes was twice as high, $500,000, the cost to the American taxpayer would have been:

$426 billion

This is a lot of money. Some would call this socialism. Yet even in the worst case scenario, it is less than 25 percent the cost of Bush's proposal. Is anyone arguing that bailing out banks and Wall Street investment firms isn't a socialistic policy?

You got robbed. By focusing on the homeowner, not allowing them to default, we would have shored up the financial foundation of this country. By blocking foreclosures, housing prices wouldn't have continued to collapse. People's primary investment would have remained strong. There would have been no bad commercial paper; no need to sell good assets at bargain basement prices; and no loss of confidence in the world's financial system. All this for a price in the range of $213B — $426B.

Keep in mind that the govenment would have owned these properties. People would have paid monthly to remain in the homes, although less than the previously scheduled amounts. Yet the government, i.e., the taxpayer, would have gotten their money back — by investing in the American people.

We don't have leaders in Washington — we have partisan ideologues. You are the loser. They took care of their friends. You paid the bill!

Let me get right to the point. The Bush administration's federal bailout proposal, as furthered by Treasury Secretary Paulson, will not work; in fact, it will make our financial crisis even worse. Keep in mind I warned readers in 2002-03 that blazing into Iraq would result in disasterous consequences. Usama bin Laden and al Qaeda prayed for us to take this misguided action — for they wanted to bankrupt the United States of America.

This solution will not be pain free. There are few good options left. The federal government must initiate a ground up rescue. By preventing foreclosures, halting bankruptcies, and restructuring homeowner debt, the paper IOUs at the bottom of the commercial credit food chain will remain viable. If the foundation remains strong, then the subsequent levels of securities IOUs will remain solvent as well. Ultimately, this is an issue of confidence. If a domino at the bottom falls, it will take others with it. As Wall Street firms have leveraged their obligations 20-30 times (or more), the fall of a single domino causes a financial chain reaction throughout the global economic community.

Periodical Updates Added Below

[UPDATE: 10.14.08] Financial Bailout: Take Two

The original Bush/Paulson/Bernanke proposal requested $700 billion to buy up toxic commercial paper, but this plan did not satisfy markets. European leaders went in another direction — nationalization of financial institutions. Paulson's new plan follows the European lead. US$250 billion will be used to purchase equity positions in America's banks: $125 billion will go to nine institutions, among them Citigroup, Wells Fargo, Goldman Sachs, JP Morgan Chase and Morgan Stanley. Another $125 billion will go to smaller institutions.

The Federal Deposit Insurance Corporation will also guarantee newly issued senior unsecured debt of banks, thrifts, and certain holding companies, and provide full coverage of non-interest bearing deposit transaction accounts, regardless of dollar amount.

[UPDATE: 10.7.08] After Bailout, AIG Execs Rewarded at Luxury Resort

Less than a week after taxpayers committed $85 billion to bail out AIG, their top execs headed for a week-long retreat at the luxury resort and spa, St. Regis Resort. "Rooms can cost over $1,000 a night," Congressman Henry Waxman (D-CA) reported.

The company (taxpayers) paid more than $440,000 for the retreat, including nearly $200,000 for rooms, $150,000 for meals and $23,000 in spa charges. "They're getting pedicures and manicures and the American people" are getting screwed, said Cong. Elijah Cummings (D-MD). "This unbridled greed," said Cong. Mark Souder (R-IN), "it's an insensitivity to how people are spending our dollars." [source]

[UPDATE: 10.6.08] As we had originally recommended, the solution for this crisis begins at the bottom, the home owners on Main Street. This partial plan costs less than $10 billion — compared to the Bush's in progress top down, "Save the Fat Cats on Wall Street, approach that currently runs over $1,000 billion.

Bank of America announced a plan to cut monthly housing payments, including mortgage, property taxes and insurance, to no more than 34 percent of gross income. The move is expected to help keep as many as 400,000 troubled borrowers in their homes.

Cheaper than foreclosure

The new program comes with a price tag of $8.4 billion, but Simon says that it will cost much less than foreclosing on homes en masse. As the credit crisis continues, more and more lenders and mortgage servicers are coming to grips with the fact that preventing a foreclosure is usually cheaper than going through the repossession process and then reselling the property in a declining market. [source]

[UPDATE: 10.3.08] The Greatest Rip-off Ever

On Monday House Republicans took a principed stand to save Reaganomics and voted down the Bush/Paulson $700 billion Wall Street bailout bill. While I disagreed with their reasoning, I applauded its failure. The measure floated into the U.S. Senate on Wednesday. Our esteemed senators made a few revisions, increased the total cost, passed the sucker, and returned it to the House. Paulson's "Troubled Asset Relieve Program" (TARP) or "trash for cash," now an $850 billion measure due to increases in the FDIC cap and various tax give-aways, passed the House 263 to 171. Bush will rush to sign it later today. His Wall Street cronies are waiting!

Don't get me wrong, something needed to be done, but this wasn't the best approach, and it will cost you much, much more down the road. Remember that it was October 2002 when the U.S. Senate gave Bush unlimited power to go to war in Iraq. Stupid is as stupid does...

[UPDATE: 10.1.08] NPR reports that, "since the Bush administration proposed the bailout this month, more than 200 economists have signed a petition opposing it." While I have not signed the petition, I fully support these experts. [source]

Today, the U.S. Senate debates the bailout proposal. They are going in the wrong direction. The Federal Reserve can drop the prime lending rate, making it easier and less expensive to borrow money. This will ease the credit crunch. The Treasury can help struggling investment banks to continue operations, on a case by case basis. The broad Bush/Paulson approach is inefficient and too costly. Keep calling your representatives in Washington and stop this madness! Help people on Main Street first.

[UPDATE: 9.30.08] Yesterday, the U.S. House of Representatives defeated the Bush/Paulson proposal, although John McCain had promised the nation that his leadership had secured passage of the bill. While Republican leaders failed, this creates an opportunity to reconsider the overall strategy.

Economist Nouriel Roubini explains that any systemic banking crisis requires recapitalization to avoid a massive contraction in credit. "But, purchasing toxic/illiquid assets of the financial system is not the most effective and efficient way to recapitalize the banking system." He points out that a recent study by the International Monetary Fund of 42 banking crises found that in only seven instances did the governments in question buy the toxic assets.

In the Scandinavian banking crises (Sweden, Norway, Finland) that are a model of how a banking crisis should be resolved there was not government purchase of bad assets; most of the recapitalization occurred through various injections of public capital in the banking system...

Thus the claim by the Fed and Treasury that spending $700 billion of public money is the best way to recapitalize banks has absolutely no factual basis or justification. This way of recapitalizing financial institutions is a total rip-off that will mostly benefit — at a huge expense for the US taxpayer — the common and preferred shareholders and even unsecured creditors of the banks. [source]

U.S. Rep. Jim Marshall, a business, finance and bankruptcy law professor and lawyer, summarizes the current crisis as:

The original Bush/Paulson/Bernanke proposal requested $700 billion to buy up toxic commercial paper, but this plan did not satisfy markets. European leaders went in another direction — nationalization of financial institutions. Paulson's new plan follows the European lead. US$250 billion will be used to purchase equity positions in America's banks: $125 billion will go to nine institutions, among them Citigroup, Wells Fargo, Goldman Sachs, JP Morgan Chase and Morgan Stanley. Another $125 billion will go to smaller institutions.

The Federal Deposit Insurance Corporation will also guarantee newly issued senior unsecured debt of banks, thrifts, and certain holding companies, and provide full coverage of non-interest bearing deposit transaction accounts, regardless of dollar amount.

[UPDATE: 10.7.08] After Bailout, AIG Execs Rewarded at Luxury Resort

Less than a week after taxpayers committed $85 billion to bail out AIG, their top execs headed for a week-long retreat at the luxury resort and spa, St. Regis Resort. "Rooms can cost over $1,000 a night," Congressman Henry Waxman (D-CA) reported.

The company (taxpayers) paid more than $440,000 for the retreat, including nearly $200,000 for rooms, $150,000 for meals and $23,000 in spa charges. "They're getting pedicures and manicures and the American people" are getting screwed, said Cong. Elijah Cummings (D-MD). "This unbridled greed," said Cong. Mark Souder (R-IN), "it's an insensitivity to how people are spending our dollars." [source]

[UPDATE: 10.6.08] As we had originally recommended, the solution for this crisis begins at the bottom, the home owners on Main Street. This partial plan costs less than $10 billion — compared to the Bush's in progress top down, "Save the Fat Cats on Wall Street, approach that currently runs over $1,000 billion.

Bank of America announced a plan to cut monthly housing payments, including mortgage, property taxes and insurance, to no more than 34 percent of gross income. The move is expected to help keep as many as 400,000 troubled borrowers in their homes.

Cheaper than foreclosure

The new program comes with a price tag of $8.4 billion, but Simon says that it will cost much less than foreclosing on homes en masse. As the credit crisis continues, more and more lenders and mortgage servicers are coming to grips with the fact that preventing a foreclosure is usually cheaper than going through the repossession process and then reselling the property in a declining market. [source]

[UPDATE: 10.3.08] The Greatest Rip-off Ever

On Monday House Republicans took a principed stand to save Reaganomics and voted down the Bush/Paulson $700 billion Wall Street bailout bill. While I disagreed with their reasoning, I applauded its failure. The measure floated into the U.S. Senate on Wednesday. Our esteemed senators made a few revisions, increased the total cost, passed the sucker, and returned it to the House. Paulson's "Troubled Asset Relieve Program" (TARP) or "trash for cash," now an $850 billion measure due to increases in the FDIC cap and various tax give-aways, passed the House 263 to 171. Bush will rush to sign it later today. His Wall Street cronies are waiting!

Don't get me wrong, something needed to be done, but this wasn't the best approach, and it will cost you much, much more down the road. Remember that it was October 2002 when the U.S. Senate gave Bush unlimited power to go to war in Iraq. Stupid is as stupid does...

[UPDATE: 10.1.08] NPR reports that, "since the Bush administration proposed the bailout this month, more than 200 economists have signed a petition opposing it." While I have not signed the petition, I fully support these experts. [source]

Today, the U.S. Senate debates the bailout proposal. They are going in the wrong direction. The Federal Reserve can drop the prime lending rate, making it easier and less expensive to borrow money. This will ease the credit crunch. The Treasury can help struggling investment banks to continue operations, on a case by case basis. The broad Bush/Paulson approach is inefficient and too costly. Keep calling your representatives in Washington and stop this madness! Help people on Main Street first.

[UPDATE: 9.30.08] Yesterday, the U.S. House of Representatives defeated the Bush/Paulson proposal, although John McCain had promised the nation that his leadership had secured passage of the bill. While Republican leaders failed, this creates an opportunity to reconsider the overall strategy.

Economist Nouriel Roubini explains that any systemic banking crisis requires recapitalization to avoid a massive contraction in credit. "But, purchasing toxic/illiquid assets of the financial system is not the most effective and efficient way to recapitalize the banking system." He points out that a recent study by the International Monetary Fund of 42 banking crises found that in only seven instances did the governments in question buy the toxic assets.

In the Scandinavian banking crises (Sweden, Norway, Finland) that are a model of how a banking crisis should be resolved there was not government purchase of bad assets; most of the recapitalization occurred through various injections of public capital in the banking system...

Thus the claim by the Fed and Treasury that spending $700 billion of public money is the best way to recapitalize banks has absolutely no factual basis or justification. This way of recapitalizing financial institutions is a total rip-off that will mostly benefit — at a huge expense for the US taxpayer — the common and preferred shareholders and even unsecured creditors of the banks. [source]

U.S. Rep. Jim Marshall, a business, finance and bankruptcy law professor and lawyer, summarizes the current crisis as:

"it's more accurate to say we're addicted to credit ... Getting clean will not be so easy. When credit is quickly withdrawn, everyone in the business of lending panics. Credit becomes scarce and is not available at a reasonable interest rate. Institutions that need to use credit daily start to fall like dominoes. The financial fallout — bank failures, risking a stock market crash, worthless retirement and pension funds — could kill us. We need to reduce our dependence on credit gradually but steadily and with no excuses."Marshall's alternative proposal would:

"focus less on acquiring mortgage-backed securities and be more of a tightly focused effort to minimize foreclosures and home vacancies that drive down property values for all of us. For these non-prime mortgage notes, I would give bankruptcy courts the power to modify mortgage payments to make them more realistic. I would limit the pay of not only top Wall Street executives but the traders who made millions by making this problem worse." [source]

History

On Friday, September 19th, Secretary Paulson released an amazingly brief, three-page, document that outlined his plan to "save the U.S. financial system," i.e., fat cats on Wall Street. There wasn't much to the proposal: give the secretary $700 billion in a "clean bill" — meaning no strings attached, no oversight, and no allowable review from federal agencies or the courts. Talk about creating a Financial Tsar!

The $700 billion requested by Paulson is a strange figure. How did he come up with this? "It's not based on any particular data point," a Treasury spokeswoman said. "We just wanted to choose a really large number." [source]

We've heard the false cries of the wolf from the Bush administration previously. Therefore, let's break this down. This crisis stems from the trouble in the housing market. If we use the research of Devilstower:

"There are some expectations that foreclosures could triple from today's historically high levels, meaning ultimately three pecent of mortgages could be in trouble.Bush entered the White House in 2001 with a budget surplus. He immediately begin demanding tax cuts to benefit his base — "the haves and have mores." Bush Republicans, including John McCain, have made it clear they would love to swamp the federal government with debt. They hope to end FDR's "New Deal" programs, such a Social Security and other safety net programs. This is part of their libertarian, free-market ideology. This blank check for $700 billion channeled to friends on Wall Street would go a long way to handcuffing the next president, particularly one interested in universal health care.

One percent of all mortgages — the amount now in default — comes out to $111 billion. Triple that, and you've got $333 billion. Let's round that up to $350 billion. So even if we reach the point where three percent of all mortgages are in foreclosure, the total dollars to flat out buy all those mortgages would be half of what the Bush-Paulson-McCain plan calls for.

Then we need to factor in that a purchased mortgage isn't worth zero. After all, these documents come with property attached. Even with home prices falling and some of the homes lying around unsold, it's safe to assume that some portion of these values could be recovered. In the S&L crisis, about 70 percent of asset value was recovered, but let's say we don't do that well. Let's say we hit 50 percent. Then the real outlay for taxpayers would be around $175 billion."

Rip off common citizens coming into office ... rip them off heading out the door. By any measure, scholars will conclude that George W. Bush was the greatest Republican president in U.S. history!

George W. Bush's Incompetence

Bush's negligent practices run deep. Although the CIA, in their daily presidential briefing on August 5, 2001, warned George W. Bush that Usama Bin Laden was preparing to strike inside the U.S., Bush neglected to take action. Five weeks later 19 Middle Eastern radicals attacked our nation. Bush claimed his month long vacation did not impair his judgment.

In the fall of 2002, Bush and members of his administration horrified Americans about an imminent and impending danger from the Middle East. In response the U.S. preemptively attacked Iraq six months later. No weapons of mass destruction were found; Saddam was not linked to the 9/11 terrorists. The crisis was cunningly invented to rush us into a $3 trillion war over oil with no end in sight. Secretary Paulson told us this week we must rush to bailout Wall Street. Sound familiar?

In August 2005, one of the deadliest hurricanes in history hit the U.S. coastline. While Bush and John McCain toasted McCain's birthday by eating cake in an airport celebration, nearly 2,000 Americans lost their lives. Bush told the nation that his FEMA director, Michael Brown "Brownie," was doing "a heck of a job."

Now, less than 45 days before the November presidential election, Bush announces that we are facing a Second Great Depression and the SOLE SOLUTION is to put hundreds of billions of taxpayer dollars into the unregulated and unreviewable hands of the same people who, due to their extraordinary greed and poor judgment, got us into this financial mess in the first place. Did I mention I have a bridge to nowhere in Alaska to sell you?

As with many of the current administration's plans, this proposal is flawed due to its top down approach. Bush and his Republican ideologues believe that stimulating the most wealthy will lead to economic gains that will trickle down to Main Street. Companies considered "to big to fail" will receive the lion's share of the proposed $700 billion package. Yet it is the little guy, the family living on Main Street and considered by Bush followers as "too small to save," who will rescue the nation from the grips of a Second Great Depression.

Since coming to office, Bush has focused his tax relief on those at the top. While trillions of dollars have been channeled to the most wealthy, the economy has performed miserably. Under eight years of Clinton stewardship, American businesses generated over 22 million new jobs. In contrast, Bush's Republican ideology has squeezed job creation to about five million net positions.

Bush's flawed ideology fueled a tragic insurgency in Iraq as well. The administration's plan sent too few troops into the theater, allowing our military to focus only on Saddam and his henchmen (remember the playing cards of bad guys), while leaving tens of thousands of Bathist officials and military personnel without money or dignity — but plenty of weapons and roadside bombs.

This is not the appropriate forum to debate the pros and cons of top down v. bottom up solutions, but let me give you an example of how leaders become captured by their own rhetoric and political biases.

A Child's Example

A number of years ago, I read a story about a delivery truck that had become wedged under a low handing freeway structure. The clearance was posted as 12 feet but the truck actually measured 12 feet two inches. It passed under the structure for a few feet and became wedged part way through.

City officials and their top engineers climbed ladders to inspect the dilemma. They measured the truck and freeway clearance numerous times. They discussed possibilities of bringing in hydraulic jacks to lift the structure and free the truck.

While the "experts" pondered their options, a young boy on a bike stopped by to watch the spectacle. He listened for 15-20 minutes as the engineers argued over the best way to lift the low hanging freeway.

Finally, the curious boy walked up to one of the officials and asked a simple question, "Why don't you let some of the air out of the tires on the truck?"

The experts had focused on the top down approach, while the solution was at hand from a bottom up perspective. It took a child's mind to see the most practical and effective solution.

Our "experts" in Washington are trying to lift the low hanging freeway structure. Their proposal hopes to take the economic pressure off the shoulders of leading financial firms on Wall Street. They want to buy up all the bad debt hemorrhaging in our economic system.

Adult Solutions

One of the best summaries of our current situation comes from Devilstower. This blogger captured the key ingredients of this financial meltdown. Citing research from Bob Moon and Kai Ryssday, American Public Media's Marketplace, Devilstower lists some key economic figures:

The value of the entire U.S. Treasuries market: $4.5 trillion.We know the $4.5 trillion U.S. Treasuries market is healthy. The $22 trillion invested in the U.S. stock market, while clearly suffering a bronchial infection, is fundamentally stable.

The value of the entire mortgage market: $7 trillion.

The size of the U.S. stock market: $22 trillion.

The size of the credit default swap market last year: $45 trillion.

America's internal and external debt exceeds $60 trillion, over 400 percent (4 times) of the country's annual GDP of a bit over $14 trillion. This debt can be broken down as follows Source: Daily Recogning:

- Family debt (including mortgages)— $15 trillion

- Financial debt — $17 trillion

- Non-financial firms' debt — $22 trillion

- Municipal debt — $3.5 trillion

- National debt — $11 trillion

It is the estimated $7 trillion mortgage market, due to the bursting housing bubble, where the root of the problem lies. The defaults and lack of confidence in these investor IOUs are creating unprecedented insecurities in the credit default swap market (CDS), which is believed to be closer to $70 trillion today than Moon and Ryssday's estimated $45 trillion.

This is where the top of the U.S financial truck has become wedged under the low hanging freeway structure. While national experts measure and re-measure the truck and overpass, they propose to lift the structure with a cash infusion of $700 billion to buy up the bad assets.

In this top down approach, the $700 billion becomes a paltry drop in the bucket of the $70 trillion in CDS obligations. It is approximately 1/1000th of the total. This is like paying $1 (one dollar) toward a debt of $1,000 (one thousand dollars). The single dollar does little to instill confidence that one can eventually repay the obligation. Conversely, this additional, yet ineffective, infusion of dollars in the market will likely fuel inflation and decrease the value of the dollar in world markets.

The solution? We must let the air out of the truck tires. The solution isn't to save the $70 trillion CDS market; the solution doesn't rest with the entire $7 trillion mortgage market. The problem stems from the bad commercial paper that is circulating in the global economic system.

While the Bush administration, under the direction of Secretary Paulson, wants to find the "insurgent" paper — needles in haystacks — and remove it from the system by authorizing the federal government to buy it, the solution is to prevent any more commercial paper from becoming "bad."

This solution will not be pain free. There are few good options left. The federal government must initiate a ground up rescue. By preventing foreclosures, halting bankruptcies, and restructuring homeowner debt, the paper IOUs at the bottom of the commercial credit food chain will remain viable. If the foundation remains strong, then the subsequent levels of securities IOUs will remain solvent as well. Ultimately, this is an issue of confidence. If a domino at the bottom falls, it will take others with it. As Wall Street firms have leveraged their obligations 20-30 times (or more), the fall of a single domino causes a financial chain reaction throughout the global economic community.

Bush and Paulson want to find and buy back the bad paper within a seething network of $70 trillion worth of obligations. Good luck! By stopping the bleeding at the source, with the little guy on Main Street, confidence is restored. Increased margin calls are no longer necessary. Capital is infused into the system at the most effective point — the bottom. Let's look at a real life example:

"As the credit bubble grew in 2006, Bear Stearns, then one of the leading mortgage traders on Wall Street, bought 2,871 mortgages from lenders like the Countrywide Financial Corporation.NOTE: The emphasis is mine in the above paragraph. Bloomberg News estimates that 23 percent of the remaining loans are "toxic" — meaning currently delinquent or in foreclosure. By ending foreclosures and assisting homeowners who are delinquent, we stop the financial bleeding. This brings stability to Wall Street and also balances government assistance. We keep families in their homes and stabilize home prices in neighborhoods where they are currently in free fall.

The mortgages, with an average size of about $450,000, were Alt-A loans — the kind often referred to as liar loans, because lenders made them without the usual documentation to verify borrowers’ incomes or savings. Nearly 60 percent of the loans were made in California, Florida and Arizona, where home prices rose — and subsequently fell — faster than almost anywhere else in the country.

Bear Stearns bundled the loans into 37 different kinds of bonds, ranked by varying levels of risk, for sale to investment banks, hedge funds and insurance companies.

If any of the mortgages went bad — and, it turned out, many did — the bonds at the bottom of the pecking order would suffer losses first, followed by the next lowest, and so on up the chain. By one measure, the Bear Stearns Alt-A Trust 2006-7 has performed well: It has suffered losses of about 1.6 percent. Of those loans, 778 have been paid off or moved through the foreclosure process.

But by many other measures, it’s a toxic portfolio. Of the 2,093 loans that remain, 23 percent are delinquent or in foreclosure, according to Bloomberg News data. Initially rated triple-A, the most senior of the securities were downgraded to near junk bond status last week. Valuing mortgage bonds, even the safest variety, requires guesstimates: How many homeowners will fall behind on their mortgages? If the bank forecloses, what will the homes sell for? Investments like the Bear Stearns securities are almost certain to lose value as long as home prices keep falling."[source]

And, just as one default can multiply through the system 20-30 times, each secured mortgage multiplies confidence upward through the network. The global panic and potential financial meltdown is averted and capital begins to loosen up and again flow freely. Let's hear how Hillary Clinton would implement such a plan:

"I've proposed a new Home Owners' Loan Corporation (HOLC), to launch a national effort to help homeowners refinance their mortgages. The original HOLC, launched in 1933, bought mortgages from failed banks and modified the terms so families could make affordable payments while keeping their homes. The original HOLC returned a profit to the Treasury and saved one million homes. We can save roughly three times that many today. We should also put in place a temporary moratorium on foreclosures and freeze rate hikes in adjustable-rate mortgages. We've got to stem the tide of failing mortgages and give the markets time to recover.By putting billions of dollars into the hands of Main Street Americans who are in trouble, turbulence in the markets will be calmed. The initial $150 billion infusion in relief by the Bush administration went to everyone. It wasn't focused. Families in need couldn't prevent their financial collapse with a one-time check for $600 or $1,200. Families doing well didn't need the money. Struggling households must be rescued and saved from mortgage default and bankruptcy. If their IOU remains good, all IOUs up the chain remain structurally sound. Confidence is restored.

... This historic intervention demands a historic shift in priorities: an end to the broken culture on Wall Street, and the broken economic policies in Washington.

Corporations that will benefit must be held accountable, not only to large shareholders but also to the American people, who are rightly tired of business as usual: short-term profit at the expense of long-term viability; lax oversight and regulation; obscene bonuses and golden parachutes regardless of performance; reckless risk-taking that has placed the markets in jeopardy; rewards for foreclosing on middle-class families and selling mortgages designed to fail; and outsourcing good jobs to serve short-term stock prices instead of America's long-term economic health." [source]

Let the air out of the tires of this runaway truck or suffer the collapse of the entire financial freeway system. It's your money and you've been warned! Don't trust the Robbers who are running the bank.