Political Issues

Republican & Democratic Congressional Members during 2023 State of the Union Address: Who's Who?

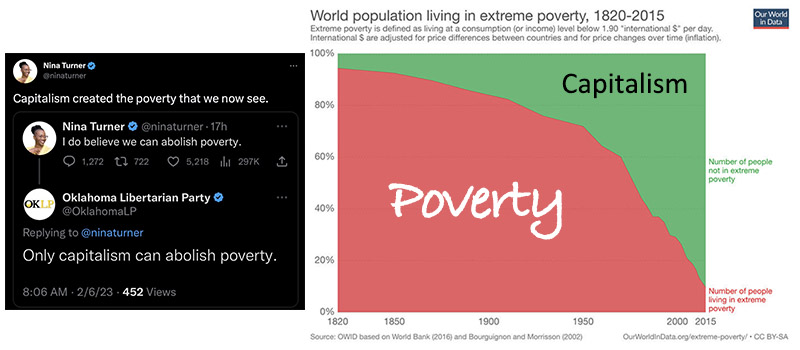

Reality of Capitalism Across the World

Nina Turner Claims Capitalism Created the Poverty That We Now See

Social Security

Have you heard that Social Security is going bankrupt? Driving up the deficit? In crisis?

Well, none of that is true. These are all myths that opponents of Social Security have been spreading to scare people into accepting benefit cuts this fall. But the myths are taking hold - so we have to fight back with the facts.

One example of the false assertions about Social Security comes from President Obama's co-chair on the deficit reduction task force, Alan Simpson, former Republican U.S. Senator from Wyoming. Simpson is well-known in senior advocacy groups for calling Social Security recipients greedy geezers. Mr. Simpson may not be aware that people who have paid into this system for most of their working careers will receive an average benefit of just $1,170/month - about $14,000 per year.

In an email to the executive director of the National Older Women's League, which Simpson claims is not "honest work," Simpson stated:

"If you have some better suggestions about how to stabilize Social Security instead of just babbling into the vapors, let me know. And yes, I've made some plenty smart cracks about people on Social Security who milk it to the last degree. You know 'em too. It's the same with any system in America. We've reached a point now where it's like a milk cow with 310 million tits! Call when you get honest work!" [emphasis mine]

Why is Social Security under attack? Economist Paul Krugman, writing in the New York Times, provides some answers. First, did you know that the Social Security program turned 75 last week (August 2010)? Krugman writes, "It should have been a joyous occasion, a time to celebrate a program that has brought dignity and decency to the lives of older Americans."

Yet we didn't celebrate as a nation. Republicans united and joined by a small number of Blue Dog Democrats continued their unwarrented attacks on the program. There is an absense of sound economic rationale for this negativity. As Krugman points out, "Instead, it's about ideology and posturing. And underneath it all is ignorance of or indifference to the realities of life for many Americans."

So what are the FACTS rather than the political and ideological fiction?

Social Security has been running surpluses for the last quarter-century, banking those surpluses in a special account, the so-called trust fund. The program won't have to turn to Congress for help or cut benefits until or unless the trust fund is exhausted, which the program's actuaries don't expect to happen until 2037 — and there's a significant chance, according to their estimates, that that day will never come.

Why the deception? Let's ask Dr. Krugman, a Nobel prize winning economist:

Conservatives hate Social Security for ideological reasons: its success undermines their claim that government is always the problem, never the solution. But they receive crucial support from Washington insiders, for whom a declared willingness to cut Social Security has long served as a badge of fiscal seriousness, never mind the arithmetic.

To counter these false claims along with the political and ideological posturing, I've posted accurate summary research from MoveOn.org concerning the top five myths about Social Security, as well as the real story. Please review the list and share it with your friends, family, and coworkers.

Top 5 Social Security Myths

Myth #1: Social Security is going broke.

Reality: There is no Social Security crisis. By 2023, Social Security

will have a $4.6 trillion surplus (yes, trillion with a 'T'). It can pay

out all scheduled benefits for the next quarter-century with no changes

whatsoever. [1] After 2037, it'll still be able to pay out 75% of scheduled

benefits - and again, that's without any changes. The program started

preparing for the Baby Boomers' retirement decades ago. [2] Anyone who

insists Social Security is broke probably wants to break it themselves.

Myth #2: We have to raise the retirement age because people are living longer.

Reality: This is a red-herring to trick you into agreeing to benefit cuts. Retirees are living about the same amount of time as they were in the 1930s. The reason average life expectancy is higher is mostly because many fewer people die as children than they did 70 years ago. [3] What's more, what gains there have been are distributed very unevenly - since 1972, life expectancy increased by 6.5 years for workers in the top half of the income brackets, but by less than 2 years for those in the bottom half. [4] But those intent on cutting Social Security love this argument because raising the retirement age is the same as an across-the-board benefit cut.

Myth #3: Benefit cuts are the only way to fix Social Security.

Reality: Social Security doesn't need to be fixed. But if we want to strengthen it, here's a better way: Make the rich pay their fair share. If the MOST RICH paid taxes on all of their income, Social Security would be sustainable for decades to come. [5] Right now, high earners only pay Social Security taxes on the first $106,000 of their income. [6] But conservatives insist benefit cuts are the only way because they want to protect the super-rich from paying their fair share.

Myth #4: The Social Security Trust Fund has been raided and is full of IOUs

Reality: Not even close to true. The Social Security Trust Fund isn't full of IOUs, it's full of U.S. Treasury Bonds. And those bonds are backed by the full faith and credit of the United States. [7] The reason Social Security holds only treasury bonds is the same reason many Americans do: The federal government has never missed a single interest payment on its debts. President Bush wanted to put Social Security funds in the stock market - which would have been disastrous - but luckily, he failed. So the trillions of dollars in the Social Security Trust Fund, which are separate from the regular budget, are as safe as can be.

Myth #5: Social Security adds to the deficit

Reality: It's not just wrong - it's impossible! By law, Social Security's funds are separate from the budget, and it must pay its own way. That means that Social Security can't add one penny to the deficit. [8]

Defeating these myths is the first step to stopping Social Security cuts. Can you share this list now?

Sources:

1."To Deficit Hawks: We the People Know Best on Social Security," New Deal 2.0, June 14, 2010

2. "The Straight Facts on Social Security," Economic Opportunity Institute, September 2009

3. "Social Security and the Age of Retirement," Center for Economic and Policy Research, June 2010

4. "More on raising the retirement age," Washington Post, July 8, 2010

5. "Social Security is sustainable," Economic and Policy Institute, May 27, 2010

6. "Maximum wage contribution and the amount for a credit in 2010," Social Security Administration, April 23, 2010

7. "Trust Fund FAQs," Social Security Administration, February 18, 2010

8."To Deficit Hawks: We the People Know Best on Social Security," New Deal 2.0, June 14, 2010